Retirement units have become a more affordable option for older Australians amidst the affordability crisis gripping Australia, a new study has revealed.

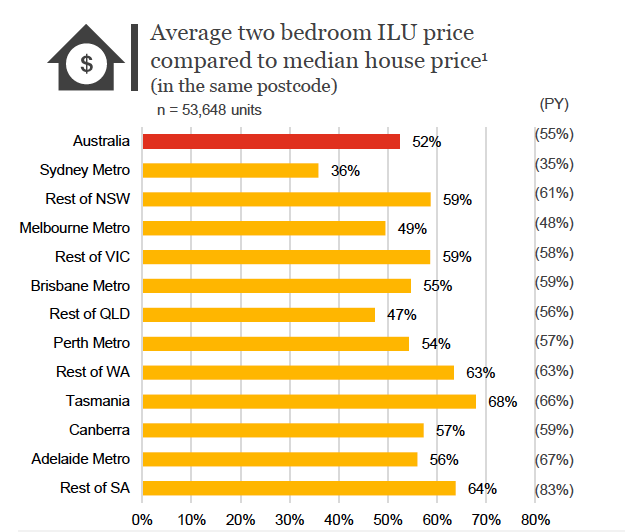

The 2022 PwC/Property Council Retirement Census found a widening affordability gap between retirement units and the traditional real estate market, with the average cost of a two-bedroom independent living unit (ILU) in a retirement village growing by just 6.6% over the 18 months to December 2022 to $516,000, compared to the 26% jump in national house prices over the same period to $831,900.

Daniel Gannon (pictured above), executive director of the Retirement Living Council, said the latest figures showed the crucial role of retirement villages in providing affordable housing options for older Australians, who were often hit hardest by cost-of-living pressures because of their fixed incomes.

“On average, units in retirement communities across Australia are 48% cheaper than the median house price in the same suburb,” Gannon said.

He said retirement villages should not be confused with aged care.

“Retirement Living communities offer a unique housing option that enhances wellbeing and lifespan for older Australians, and actually prevents the entry into aged care,” Gannon said.

“At a time when national housing affordability is eroding, and health care costs are also growing, the value proposition of retirement communities is strengthening – but there are some warning bells starting to sound.”

The census also revealed that the three-year development supply pipeline of retirement units was down by more than 50% to 5,100 dwellings, from the previous census forecast of 10,500. Findings also showed that national retirement village occupancy remained steady at nearly full capacity of 90%.

“The reality is, we have a market that’s pretty much full, which actually provides an affordable housing option when few other affordable options remain, and yet barriers to building more are emerging,” Gannon said.

“It’s not an unfamiliar story for this part of the housing market. Higher construction and debt costs together with general economic uncertainty has applied downward pressure on the supply pipeline.”

He urged caution to policymakers, given supply is forecast to ease and with ongoing legislative reviews expected to impact Victoria, Queensland, South Australia, Western Australia, and Tasmania.

“If governments make it harder for operators to build and operate retirement communities, the supply clamp will tighten even further – on a sector that we know offers an affordable and bespoke offering for older Australians, who simply can’t keep up with the traditional market which is becoming increasingly unaffordable to rent or buy into,” Gannon said.

From 4.4 million, the number of people aged over 65 is expected to increase to 6.6 million by 2041, presenting opportunities and risks for governments, he said.

“Australia’s population is ageing, which means our three tiers of government need to address and solve the challenges associated with housing this demographic cohort now,” Gannon said.

“If more seniors are living in age-friendly communities, there is significant economic upside for state and federal governments through reduced interaction with the health system and delayed entry to aged care.”

Use the comment section below to tell us how you felt about this.